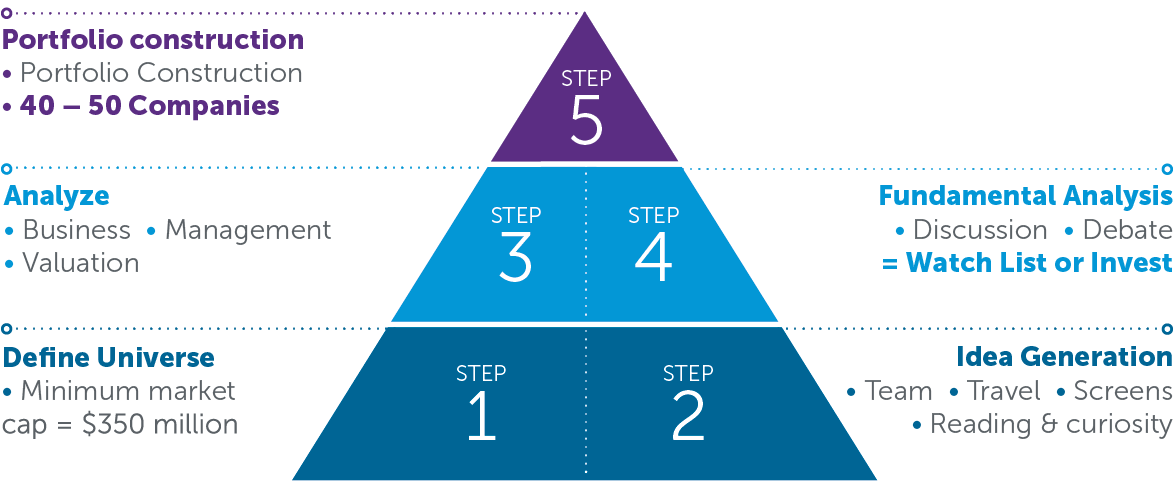

When we select equities for our funds, we follow a rigorous five-step process. We believe that this approach to stock picking has the potential to deliver consistent long-term returns.

- Define Universe - First we define the universe by minimum market capitalization – a $350 million minimum market cap allows for ideas in smaller companies to flow into the portfolio.

- Idea Generation - Second step is idea generation. We leverage the entire team to generate ideas among the

portfolios – not just among equity managers; our fixed income team can provide valuable insights into things like credit research on the same companies under consideration for our equity portfolios. Travelling to visit companies and investment conferences provides further perspectives. Quantitative screens – such as discounted cash flow analysis – can help narrow the universe, particularly when dealing with a large market, such as international equities. Reading and curiosity refers to that fundamental and contrarian mindset, where the goal is to be different from our competitors.

- Analyze- Step three is about analyzing the company, in which there are three primary factors:

-

Business – Is there a competitive advantage? What’s the company’s track record in delivering return on invested capital? Can they continue to grow?

-

Management – Are managers’ incentives aligned with that of the shareholders? Do they have a long term view and focus on return on invested capital? Is there a long runway and limited risk of a major competitor coming into the market?

-

Valuation – Are we purchasing this company at a discount to its long term value (intrinsic value) and getting an acceptable margin of safety?

We use discounted cash flow analysis; and normalized earnings power for commodity based companies. We also look at relative multiples, such as price to earnings and price to book value.

-

-

Fundamental Analysis - Step four is discussion and debate around our fundamental analysis among the team members (portfolio managers and analysts). After completing our fundamental analysis, we will invest in a company, put it on a watch list, or consider a company not investable.

-

Portfolio Construction - Portfolio construction relates to managing the overall characteristics of the portfolio. If a new company does make it in the portfolio, we will more likely remove another company, as we want to maintain concentrated portfolios. Throughout the process we aim for well diversified portfolios to mitigate downside risks. Our mandates will typically hold 40-50 stocks.

http://www.empirelifeinvestments.ca/en/fixed-income-investment-process